B2Gold: Der Top-Performer im Goldsektor, WKN A0M889 (Seite 125)

eröffnet am 03.07.16 13:29:15 von

neuester Beitrag 30.05.24 09:53:22 von

neuester Beitrag 30.05.24 09:53:22 von

Beiträge: 1.302

ID: 1.234.579

ID: 1.234.579

Aufrufe heute: 95

Gesamt: 149.913

Gesamt: 149.913

Aktive User: 0

ISIN: CA11777Q2099 · WKN: A0M889 · Symbol: 5BG

2,5850

EUR

-0,50 %

-0,0130 EUR

Letzter Kurs 31.05.24 Tradegate

Neuigkeiten

| TitelBeiträge |

|---|

18.05.24 · Jörg Schulte Anzeige |

10.05.24 · inv3st.de Anzeige |

09.05.24 · Jörg Schulte Anzeige |

08.05.24 · globenewswire |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 74,01 | +99.999,00 | |

| 1,0000 | +53,85 | |

| 1.056,00 | +17,69 | |

| 794,35 | +12,21 | |

| 0,5500 | +10,00 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 52,80 | -6,99 | |

| 25,56 | -7,96 | |

| 2,3900 | -8,08 | |

| 0,6300 | -16,56 | |

| 46,92 | -98,01 |

Beitrag zu dieser Diskussion schreiben

Bodenbildung und erste Gegenbewegung nach der Konsolidierung beim Goldpreis.

Tut auch dem Aktienkurs gut.

Mal sehen wie weit es nach oben geht.

Bin neben meinem Long-Investment jetzt auch mit einer weiteren Trading-Position dabei.

Tut auch dem Aktienkurs gut.

Mal sehen wie weit es nach oben geht.

Bin neben meinem Long-Investment jetzt auch mit einer weiteren Trading-Position dabei.

B2Gold Corp.: Notice of Philippines DENR (Department of Environment and Natural Resources) Audit Results 18.10.16 - 23:30 Uhr

http://www.minenportal.de/artikel.php?sid=181131&lang=en#B2G…

We have received and analyzed the comprehensive Audit Report findings and determined that they are broadly consistent with the Preliminary Notice and the action plan developed to date. The points raised are principally related to administrative and regulatory compliance issues which B2Gold is confident will be resolved by continuing to work closely with the appropriate government agencies. The Company is well positioned to respond to the matters raised in the Audit Report and expects to do so by Friday, October 21, 2016, which is within the seven-day timeframe provided in accordance with DENR guidelines.

http://www.minenportal.de/artikel.php?sid=181131&lang=en#B2G…

We have received and analyzed the comprehensive Audit Report findings and determined that they are broadly consistent with the Preliminary Notice and the action plan developed to date. The points raised are principally related to administrative and regulatory compliance issues which B2Gold is confident will be resolved by continuing to work closely with the appropriate government agencies. The Company is well positioned to respond to the matters raised in the Audit Report and expects to do so by Friday, October 21, 2016, which is within the seven-day timeframe provided in accordance with DENR guidelines.

Nach Meinung dieses Schreibers besteht die Gefahr auf Masbate (Philippinen) immer noch, ich verstehe die oben angeführte Nachricht auf Bloomberg, aber eher als Entwarnung! Jedoch wer weiß... ein gewisses Rückschlagpotential besteht natürlich - trotz Kursrückgang direkt nach der Nachricht bezüglich der Konzession- immer noch. Duerte sollte man vielleicht nicht unterschätzen.

Was der Autor - nach meinem Verständnis - aber nicht korrekt darstellt ist der Grund für die Probleme. Er spricht von Problemen die Umwelt betreffend, B2 spechen in ihrer Erwiderung lediglich von verwaltungstechnischen Problemen.

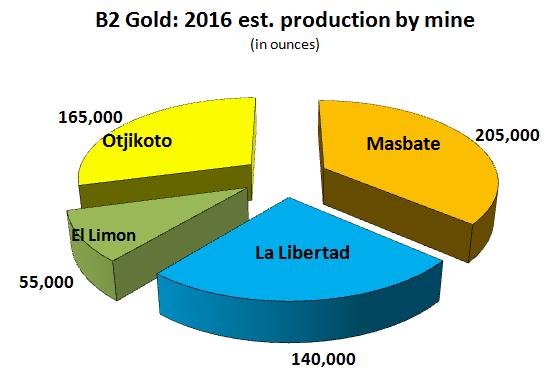

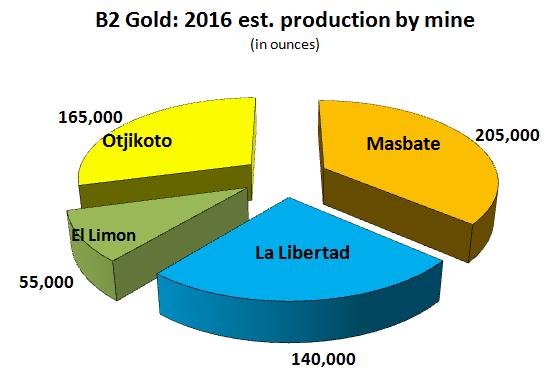

Most recently the company encountered some environmental problems related to its Masbate mine, located in Philippines. Together with 20 other miners B2 Gold is endangered with suspension of its flagship property. I am monitoring the situation but, unfortunately, it looks like the new secretary of DENR (Department of Environment and Natural Resources) wants to turn the Philippines resource sector upside down. In my opinion, Masbate is in serious danger and, due to the fact that this mine delivers the highest amount of gold for the company, its suspension would have a significant, negative impact on B2 Gold performance:

Hier die Verteilung:

Trotzdem seine Schlussfolgerung:

Well, I think that B2 Gold is one of the world's best miners and is the core element of my Top Five Picks portfolio.

http://seekingalpha.com/article/4012935-top-five-picks-curre…

Was der Autor - nach meinem Verständnis - aber nicht korrekt darstellt ist der Grund für die Probleme. Er spricht von Problemen die Umwelt betreffend, B2 spechen in ihrer Erwiderung lediglich von verwaltungstechnischen Problemen.

Most recently the company encountered some environmental problems related to its Masbate mine, located in Philippines. Together with 20 other miners B2 Gold is endangered with suspension of its flagship property. I am monitoring the situation but, unfortunately, it looks like the new secretary of DENR (Department of Environment and Natural Resources) wants to turn the Philippines resource sector upside down. In my opinion, Masbate is in serious danger and, due to the fact that this mine delivers the highest amount of gold for the company, its suspension would have a significant, negative impact on B2 Gold performance:

Hier die Verteilung:

Trotzdem seine Schlussfolgerung:

Well, I think that B2 Gold is one of the world's best miners and is the core element of my Top Five Picks portfolio.

http://seekingalpha.com/article/4012935-top-five-picks-curre…

Na wenn die Anal ysten es schon sagen....

Scotiabank Reiterates “Outperform” Rating for B2Gold Corp. (BTO)

http://www.mareainformativa.com/scotiabank-reiterates-outper…

Scotiabank Reiterates “Outperform” Rating for B2Gold Corp. (BTO)

http://www.mareainformativa.com/scotiabank-reiterates-outper…

Antwort auf Beitrag Nr.: 53.065.341 von edorado am 15.08.16 22:17:39

Es wäre jetzt interessant zu wissen wieviele davon jetzt schon über die Ladentheke gewandert sind!

Nachdem die Probleme auf den Philippinen hoffentlich ausgeräumt sind, siehe Posting vorher, dürfte ,wenn das Marktumfeld mitspielt, die Tür zu neuen Höhen offen stehen!

Zitat von edorado: Aktienausgabe für Investitionen in neue Minenprojekte.

B2Gold launches $100m at-the-market offering

13th August 2016

VANCOUVER (miningweekly.com) – Canadian midtier gold producer B2Gold announced on Friday that it would distribute an at-the-market offering of $100-million worth of common shares from time to time through designated broker-dealers at prevailing market prices.

Es wäre jetzt interessant zu wissen wieviele davon jetzt schon über die Ladentheke gewandert sind!

Nachdem die Probleme auf den Philippinen hoffentlich ausgeräumt sind, siehe Posting vorher, dürfte ,wenn das Marktumfeld mitspielt, die Tür zu neuen Höhen offen stehen!

Sehr guter Artikel über B2:

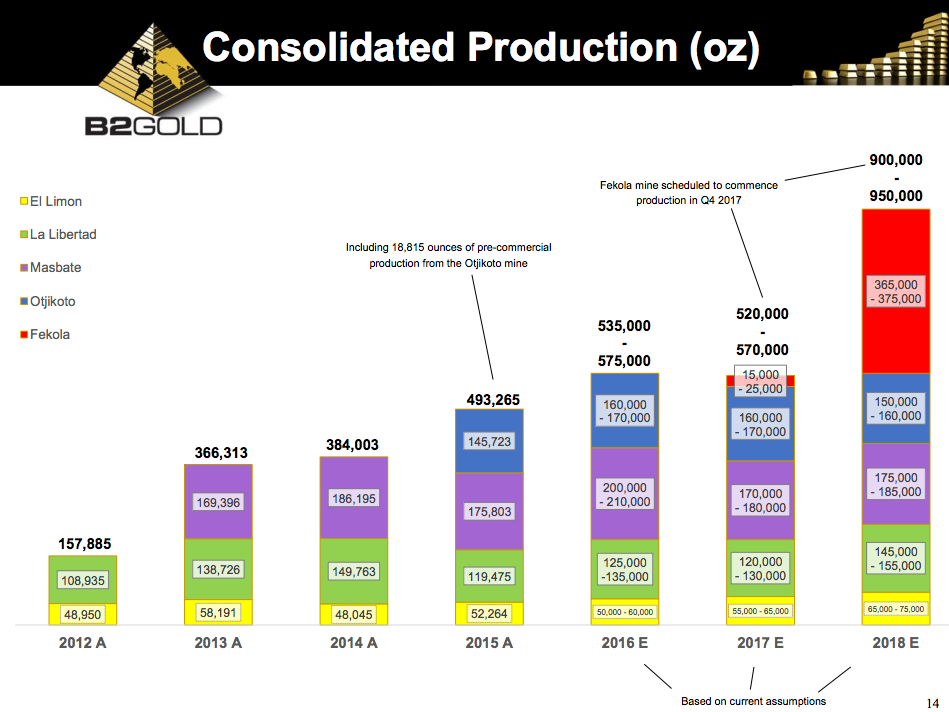

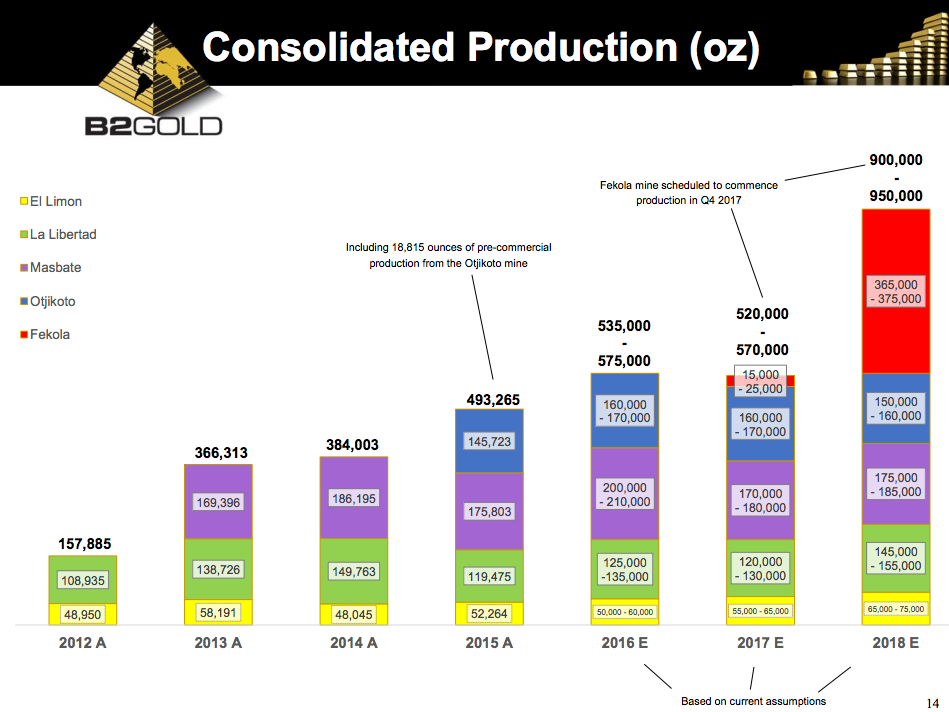

B2Gold is one of the fastest-growing gold miners on the planet. Next year, it estimates steady production between 520,000 and 570,000 ounces, but once Fekola comes on-line in 2018, this is expected to increase significantly to 900,000-950,000 ounces, while also reducing the company's total all-in sustaining costs. Meanwhile, Fekola is fully funded to production.

http://seekingalpha.com/article/4012727-b2gold-solid-quarter…

B2Gold is one of the fastest-growing gold miners on the planet. Next year, it estimates steady production between 520,000 and 570,000 ounces, but once Fekola comes on-line in 2018, this is expected to increase significantly to 900,000-950,000 ounces, while also reducing the company's total all-in sustaining costs. Meanwhile, Fekola is fully funded to production.

http://seekingalpha.com/article/4012727-b2gold-solid-quarter…

GLD bullion inventories keep going up

Gold price flatlines, but somebody somewhere doesn't care. The buying in GLD gold continues, the inventory level swells.

I happened to mention the trend on Friday, since then another 5.64 metric tonnes of gold has been added to the pot.

http://incakolanews.blogspot.de/2016/10/gld-bullion-inventor…

Gold price flatlines, but somebody somewhere doesn't care. The buying in GLD gold continues, the inventory level swells.

I happened to mention the trend on Friday, since then another 5.64 metric tonnes of gold has been added to the pot.

http://incakolanews.blogspot.de/2016/10/gld-bullion-inventor…

BRIEF-B2Gold says construction of Fekola mine is progressing on schedule

Oct 13 B2Gold Corp :

* Says quarterly consolidated gold production of 146,686 ounces 18% greater than same period in 2015

* "Construction of Fekola mine is progressing well, on schedule and on budget[/b]"

Oct 13 B2Gold Corp :

* Says quarterly consolidated gold production of 146,686 ounces 18% greater than same period in 2015

* "Construction of Fekola mine is progressing well, on schedule and on budget[/b]"

B2Gold Corp (BTG) Given Average Rating of “Buy” by Analysts

October 14th, 2016 -

B2Gold Corp logoShares of B2Gold Corp (NYSE:BTG) have been given an average rating of “Buy” by the ten analysts that are presently covering the firm.

Three equities research analysts have rated the stock with a hold recommendation and seven have assigned a buy recommendation to the company.

The average 12 month price target among brokerages that have covered the stock in the last year is $5.07.

Institutional investors have recently bought and sold shares of the stock. Schroder Investment Management Group purchased a new position in B2Gold Corp during the second quarter valued at about $2,188,000.

I.G. Investment Management LTD. raised its position in B2Gold Corp by 2.8% in the second quarter. I.G. Investment Management LTD. now owns 8,483,386 shares of the company’s stock valued at $21,277,000 after buying an additional 234,402 shares during the last quarter.

TD Asset Management Inc. raised its position in B2Gold Corp by 50.3% in the second quarter. TD Asset Management Inc. now owns 9,434,900 shares of the company’s stock valued at $23,538,000 after buying an additional 3,155,875 shares during the last quarter.

Her Majesty the Queen in Right of the Province of Alberta as represented by Alberta Investment Management Corp raised its position in B2Gold Corp by 130.4% in the second quarter. Her Majesty the Queen in Right of the Province of Alberta as represented by Alberta Investment Management Corp now owns 2,080,180 shares of the company’s stock valued at $6,740,000 after buying an additional 1,177,270 shares during the last quarter.

Finally, Emerald Acquisition Ltd. bought a new position in B2Gold Corp during the second quarter valued at $1,862,000.

October 14th, 2016 -

B2Gold Corp logoShares of B2Gold Corp (NYSE:BTG) have been given an average rating of “Buy” by the ten analysts that are presently covering the firm.

Three equities research analysts have rated the stock with a hold recommendation and seven have assigned a buy recommendation to the company.

The average 12 month price target among brokerages that have covered the stock in the last year is $5.07.

Institutional investors have recently bought and sold shares of the stock. Schroder Investment Management Group purchased a new position in B2Gold Corp during the second quarter valued at about $2,188,000.

I.G. Investment Management LTD. raised its position in B2Gold Corp by 2.8% in the second quarter. I.G. Investment Management LTD. now owns 8,483,386 shares of the company’s stock valued at $21,277,000 after buying an additional 234,402 shares during the last quarter.

TD Asset Management Inc. raised its position in B2Gold Corp by 50.3% in the second quarter. TD Asset Management Inc. now owns 9,434,900 shares of the company’s stock valued at $23,538,000 after buying an additional 3,155,875 shares during the last quarter.

Her Majesty the Queen in Right of the Province of Alberta as represented by Alberta Investment Management Corp raised its position in B2Gold Corp by 130.4% in the second quarter. Her Majesty the Queen in Right of the Province of Alberta as represented by Alberta Investment Management Corp now owns 2,080,180 shares of the company’s stock valued at $6,740,000 after buying an additional 1,177,270 shares during the last quarter.

Finally, Emerald Acquisition Ltd. bought a new position in B2Gold Corp during the second quarter valued at $1,862,000.

GLD gold inventories are rising again

17.04.24 · wO Chartvergleich · Borussia Dortmund |

03.04.24 · Zukunftsbilanzen · Barrick Gold Corporation |

12.03.24 · nebenwerte ONLINE · Barrick Gold Corporation |

11.03.24 · Zukunftsbilanzen · Barrick Gold Corporation |